While the cryptocurrency market experiences a period of correction, XRP, the native token of Ripple, stands out as a beacon of green. Unlike its major counterparts like Bitcoin and Ethereum that have dipped in recent weeks, XRP has defied the trend, showcasing a price increase. This bullish behavior has grabbed the attention of investors and analysts alike, sparking questions about the reasons behind XRP’s resilience and its potential future trajectory.

XRP‘s Recent Performance: A Sign of Underlying Strength?

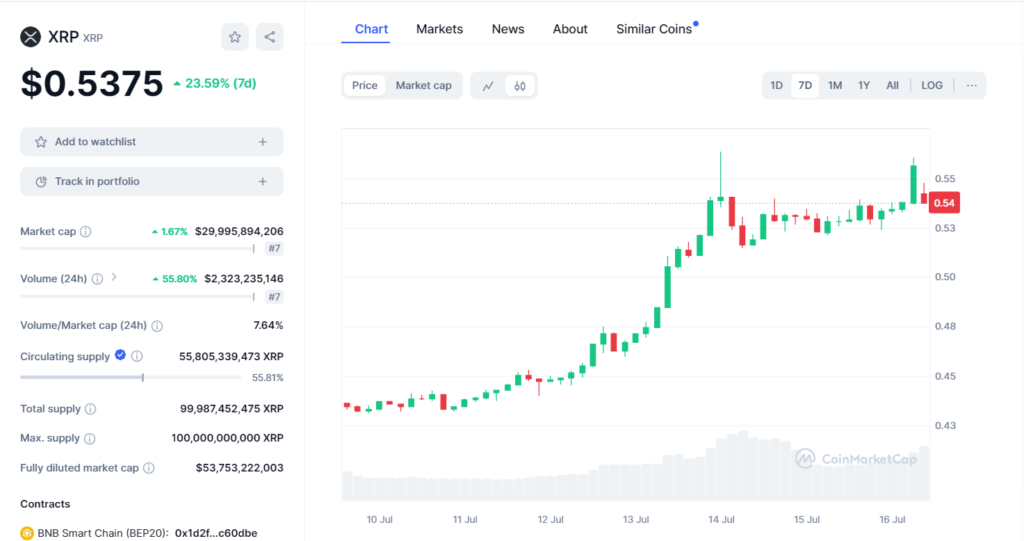

As of July 16, 2024, XRP is experiencing a price increase of approximately 3% compared to the previous 24 hours. This positive movement comes amidst a broader market downturn, highlighting XRP’s potential to act independently from the overall market sentiment. There are multiple reasons for this resiliency.

1. The Ripple vs. SEC Lawsuit: A Cloud with a Silver Lining?

The ongoing legal dispute between the United States and Ripple. Securities and Exchange Commission (SEC) has undoubtedly cast a shadow over XRP’s price in the past. XRP is allegedly an unregistered security, according to the SEC. However, a recent court ruling in July 2023 provided some relief for Ripple. The judge rejected the SEC’s attempt to designate XRP as a security, a move that many analysts believe could be a turning point in the lawsuit. This positive development has likely instilled confidence in XRP holders, contributing to the recent price increase.

2. Utility and Adoption Driving Value?

XRP’s core function lies in facilitating fast and cheap cross-border transactions. Ripple’s technology, RippleNet, is designed to revolutionize the global payments system by offering financial institutions a more efficient alternative to traditional SWIFT transfers. Several major financial institutions like Santander and Standard Chartered have already partnered with Ripple, indicating a growing adoption of RippleNet. This real-world utility could be another factor contributing to XRP’s recent price appreciation.

3. Market Speculation and Anticipation

The ongoing lawsuit and potential for a favorable outcome have undoubtedly fueled speculation in the XRP market. Investors who believe in the long-term potential of Ripple and XRP might be taking advantage of the current price point to accumulate XRP in anticipation of future growth. This positive sentiment could be another reason behind XRP’s current bullish trend.

Is XRP‘s Green Streak Sustainable?

While XRP’s recent performance is encouraging, predicting the future of any cryptocurrency remains a challenging task. The overall market conditions, the outcome of the SEC lawsuit, and Ripple’s continued development and adoption will all play a crucial role in determining XRP’s long-term viability.

Factors to Consider for XRP’s Future:

- SEC Lawsuit Resolution: A definitive ruling in Ripple’s favor could significantly boost XRP’s price and adoption. On the other hand, a negative result can have the opposite impact.

- RippleNet Adoption: Increased adoption of RippleNet by financial institutions would validate XRP’s utility and likely drive its price upwards.

- Market Recovery: A broader market recovery could lift all cryptocurrencies, including XRP. However, a sustained market downturn could potentially impact XRP’s momentum.

XRP: A Long-Term Play?

Despite the inherent uncertainties, XRP’s recent performance and underlying fundamentals suggest it could be a promising long-term investment for crypto enthusiasts. Here are some important things to remember:

- Unique Value Proposition: XRP offers a distinct value proposition within the cryptocurrency landscape, focusing on real-world application in the financial services sector.

- Strong Development Team: Ripple boasts a team of experienced professionals with a proven track record in the financial technology industry.

- Growing Adoption: The increasing adoption of RippleNet by financial institutions indicates potential for future growth.

Investor Considerations:

Investors contemplating XRP should conduct thorough research and understand the inherent risks associated with cryptocurrency investments. The market remains volatile, and regulatory uncertainties persist. A well-diversified portfolio and a long-term investment approach are crucial for navigating the dynamic world of cryptocurrencies.

Conclusion

XRP’s recent surge amidst a bearish market has sparked renewed interest in its potential. While the future remains uncertain, XRP’s unique value proposition, ongoing legal battle, and increasing adoption paint an intriguing picture. For investors seeking exposure to the potential of blockchain technology in the financial sector, XRP deserves a closer look, conducted within the framework of a comprehensive investment strategy.